NC E-536R 2024-2025 free printable template

Show details

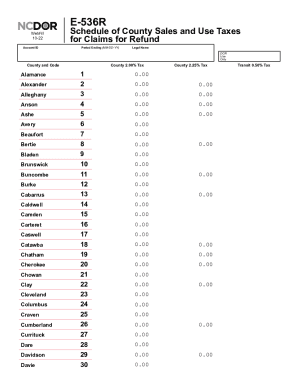

00 Food Tax. Office Use Only General Instructions Food county and transit tax amounts entered on the claim for refund must equal the total amounts by rate on Form E-536R. This chart reflects the county sales and use tax rate and transit tax rate in effect for periods beginning April 1 2019 and forward. E-536R WebFill 7-24 Account ID Schedule of County Sales and Use Taxes for Claims for Refund Period Ending MM-DD-YY PRINT CLEAR Legal Name DOR Use Only County and Code Alamance Alexander...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign e536r county use taxes form

Edit your nc e 536r form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e 536r form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nc e536r taxes claims form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit e 536r county use pdffiller form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC E-536R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nc e 536r county use taxes form

How to fill out NC E-536R

01

Obtain the NC E-536R form from the appropriate state office or website.

02

Fill out your personal information at the top of the form, including name, address, and contact details.

03

Provide relevant identification numbers, such as Social Security or Tax ID numbers.

04

Complete the sections regarding the nature of the request, ensuring all information is accurate and complete.

05

Attach any required supporting documents as specified in the instructions.

06

Review the form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the completed form to the designated office as instructed.

Who needs NC E-536R?

01

Individuals or businesses needing to request specific information or documentation from the state of North Carolina.

02

Taxpayers looking to address matters related to their tax filings.

03

Anyone seeking clarity or resolution regarding their tax status or obligations.

Fill

e 536r sales use sample

: Try Risk Free

People Also Ask about nc e 536r refund get

What is NC d400?

2021 D-400 Individual Income Tax Return.

What is the NC sales tax rate for 2022?

North Carolina has a 4.75 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 6.98 percent. North Carolina's tax system ranks 11th overall on our 2022 State Business Tax Climate Index.

What state has a 7 percent sales tax?

The highest state-level sales tax in the USA is 7%, which is charged by five states - Indiana, Tennessee, New Jersey, Mississippi, and Rhode Island.

What is E 536 NC?

Form E-536, Schedule of County Sales and Use Taxes (October 2020 - September 2022) | NCDOR.

What is food tax in Wake County North Carolina?

A 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use, or consumption of qualifying food. The transit and other local rates do not apply to qualifying food.

Is NC sales tax 7%?

North Carolina sales tax details The North Carolina (NC) state sales tax rate is currently 4.75%. Depending on local municipalities, the total tax rate can be as high as 7.5%. County and local taxes in most areas bring the sales tax rate to 6.75%–7% in most counties but some can be as high as 7.5%.

Are taxes 7 percent?

Tax Districts The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

What is the 7.25% tax in NC for?

The 7.25% sales tax rate in Raleigh consists of 4.75% North Carolina state sales tax, 2% Wake County sales tax and 0.5% Special tax. There is no applicable city tax. You can print a 7.25% sales tax table here.

What is NC sales tax rate 2022?

North Carolina sales tax details The North Carolina (NC) state sales tax rate is currently 4.75%. Depending on local municipalities, the total tax rate can be as high as 7.5%. County and local taxes in most areas bring the sales tax rate to 6.75%–7% in most counties but some can be as high as 7.5%.

What percentage is NC sales tax?

Retail sales of tangible personal property are subject to the 4.75% State sales or use tax. Items subject to the general rate are also subject to the 2.25% local rate of tax that is levied by all counties in North Carolina. Sales taxes are not charged on services or labor.

What is Wake County NC sales tax rate 2022?

The minimum combined 2022 sales tax rate for Wake County, North Carolina is 7.25%. This is the total of state and county sales tax rates. The North Carolina state sales tax rate is currently 4.75%.

What is the sales tax rate in Wake County NC?

The minimum combined 2022 sales tax rate for Wake County, North Carolina is 7.25%. This is the total of state and county sales tax rates. The North Carolina state sales tax rate is currently 4.75%.

What is a NC E 500?

Use Form E-500 to file and report your North Carolina State, local and transit sales and use taxes.

What is the sales tax rate for Raleigh NC?

What is the sales tax rate in Raleigh, North Carolina? The minimum combined 2022 sales tax rate for Raleigh, North Carolina is 7.25%. This is the total of state, county and city sales tax rates. The North Carolina sales tax rate is currently 4.75%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get nc e 536r sales use claims fill?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific nc e536r county use claims fillable and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I sign the nc e 536r county fill electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your nc e 536r use taxes refund blank in seconds.

Can I create an eSignature for the nc e536r county use claims form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your nc e 536r county online directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is NC E-536R?

NC E-536R is a tax form used in North Carolina for reporting sales and use tax.

Who is required to file NC E-536R?

Businesses and individuals who make taxable sales or purchases in North Carolina are required to file NC E-536R.

How to fill out NC E-536R?

To fill out NC E-536R, provide the necessary business details, report gross sales, exemptions, and calculate the net tax due.

What is the purpose of NC E-536R?

The purpose of NC E-536R is to report and remit sales and use tax to the North Carolina Department of Revenue.

What information must be reported on NC E-536R?

Information that must be reported includes total sales, exempt sales, taxable sales, and the amount of sales tax collected.

Fill out your NC E-536R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nc County Taxes Claims Refund Form is not the form you're looking for?Search for another form here.

Keywords relevant to nc e schedule county taxes edit

Related to nc e county taxes claims refund

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.